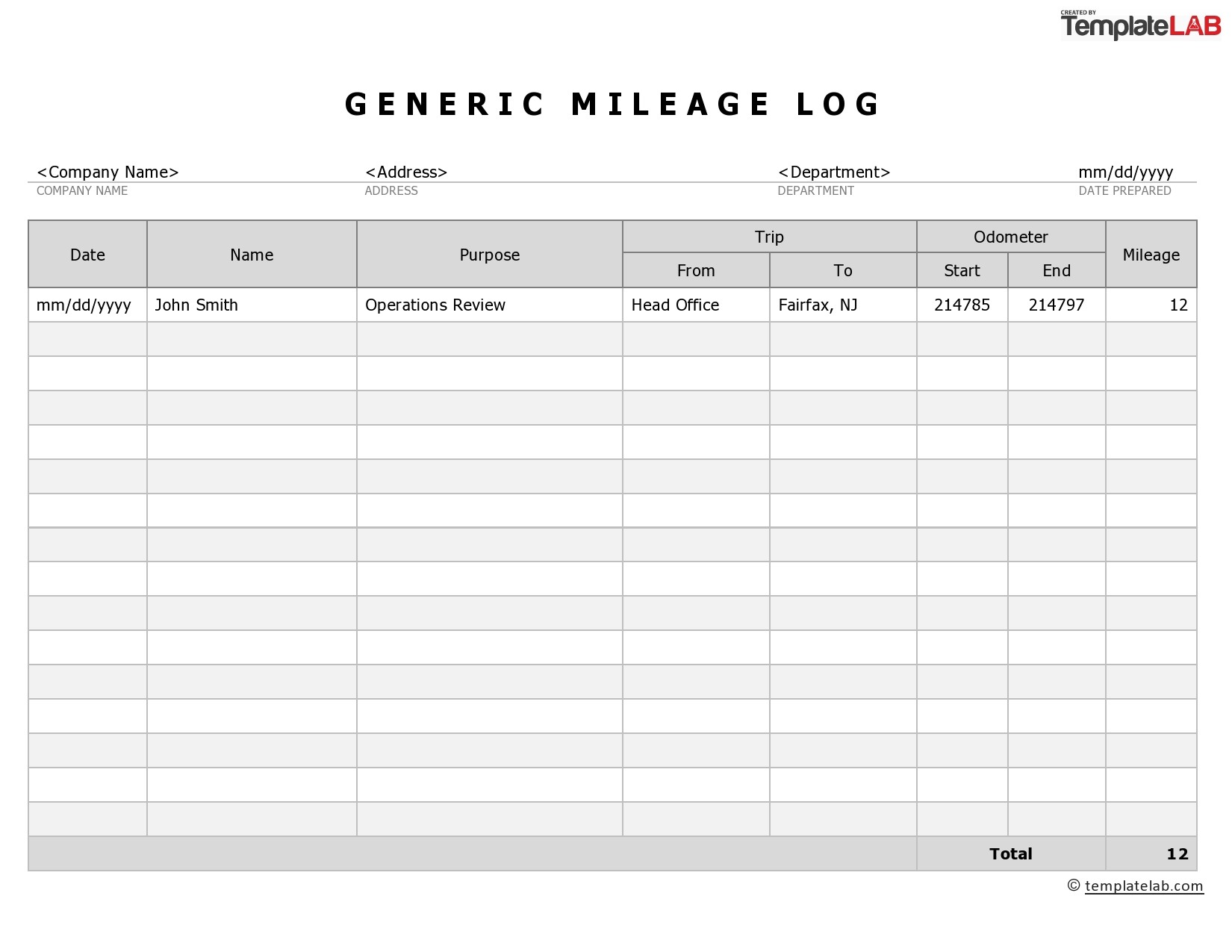

25 Free Mileage Log Templates Excel Word PDF , Our free mileage log templates will enable you to comply with all IRS regulations thus allowing you to legally and conveniently deduct business mileage expenses . 20 Printable Mileage Log Templates Free TemplateLab, Download our Free Printable Mileage Log Templates Forms and Samples 31 High Quality Mileage Log templates in Excel Word or PDF

.Free Printable Printable Mileage Log

Free Printable Printable Mileage Log

25 Free Mileage Log Templates Excel Word PDF

Our free mileage log templates will enable you to comply with all IRS regulations thus allowing you to legally and conveniently deduct business mileage expenses .

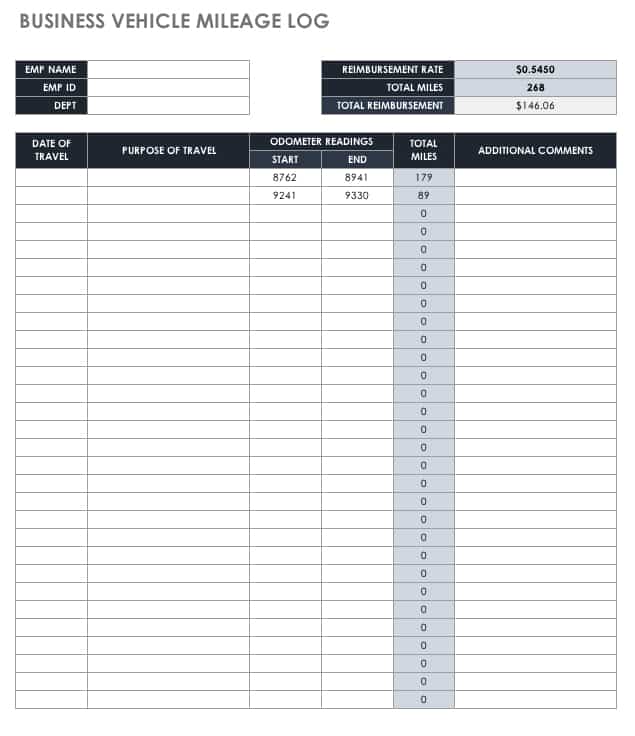

IRS Printable Mileage Log Template 2025 Free Excel PDF Driversnote

Download the free 2025 mileage log template as a PDF Sheet or Excel version and keep track of your trips Free IRS printable mileage log form to download .

IRS Printable Mileage Log Templates ExpressMileage

Benefits of Using a Printable Mileage Log for 2024 The downloadable mileage log template aligns with the IRS standard mileage rate for 2024 which is 67 cents per mile for business driving To ease your work choose from different formats a modifiable Excel file a quick PDF version or even a Google Sheets version Remember if using Google Sheets you ll need to make a copy of the .

Free Printable Mileage Log Templates PDF Excel Type Calendar

Looking for an easy and efficient way to keep track of your mileage Our free printable mileage log template has got you covered Simplify your record keeping .

8 Free Sample Mileage Log Templates Printable Samples

Download these 8 Free Sample Mileage Log Templates to help you prepare your own Mileage Log easily A Mileage Log is a personal document that you keep to enter the data of your personal and work related traveling For personal use you can just create a work sheet in Excel where you will put the date Read More 8 Free Sample Mileage Log Templates.

7 Free Mileage Log Templates Word Excel

Note IRS mileage rates for 2023 are 65 5 cents per mile if the vehicle was driven for business purposes 22 cents per mile if the vehicle was driven for medical or moving purposes for qualified active duty members of the Armed forces 14 cents per mile if the vehicle was driven for the purpose of charitable organizations It is best to track your mileage using printable log sheets .

Disclaimer: All photos included on this internet site are the residential or commercial property of their corresponding copyright proprietors. If you have any concerns or issues relating to acknowledgment or image elimination, please do not wait to contact us.