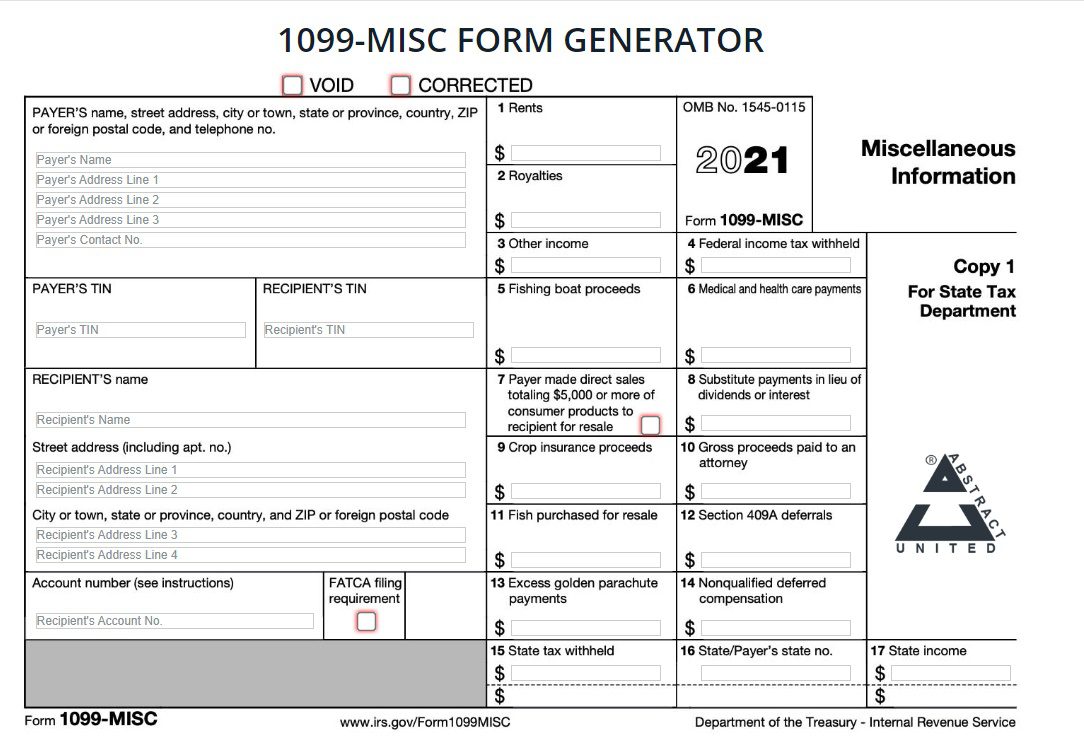

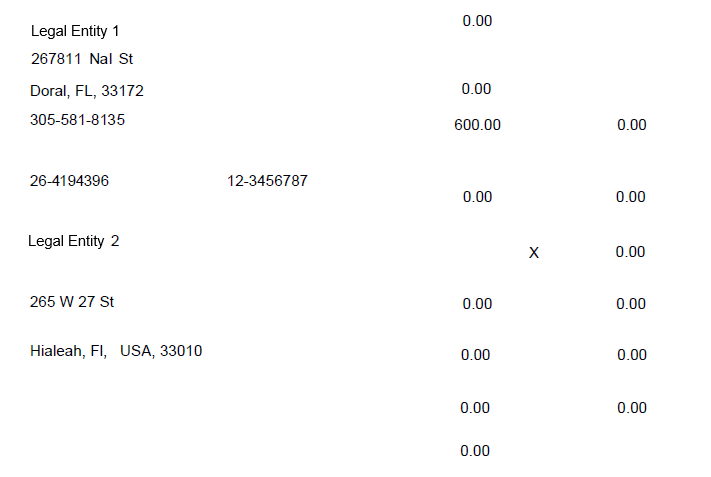

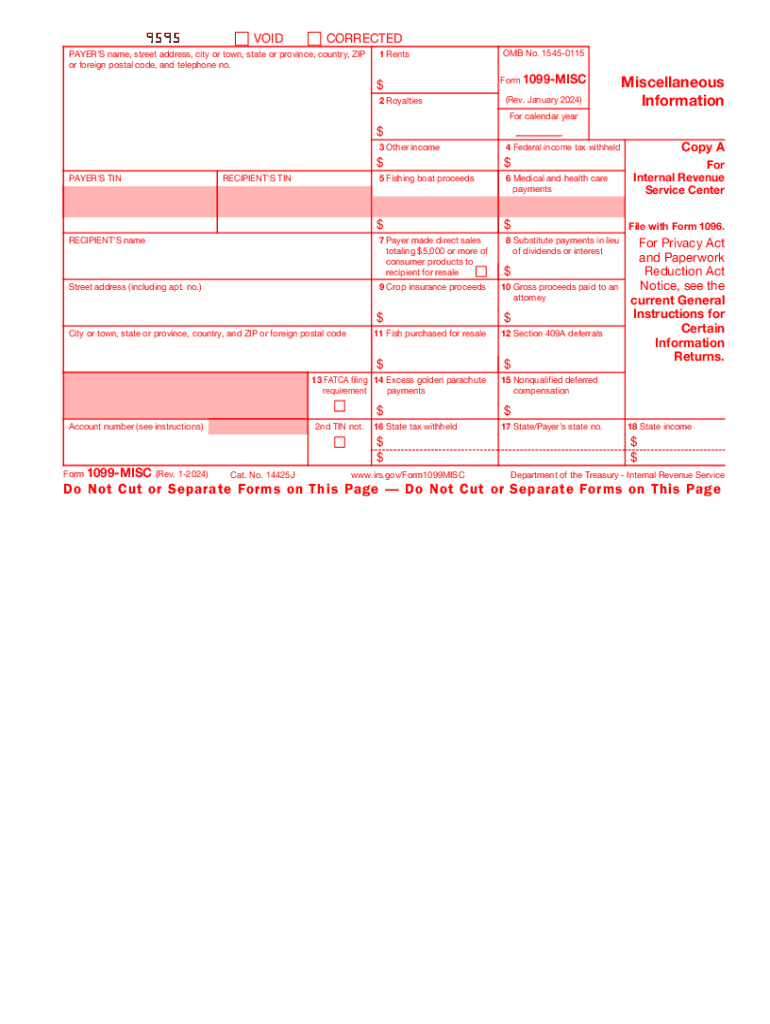

Free IRS Form 1099 MISC PDF eForms, Download a free PDF of IRS Form 1099 MISC a tax form used to report certain payments made by a business or organization Learn how to fill out the form what payments are reportable and when to file it with the IRS . How To Print 1099 Forms on Your Regular Printer Keeper, Want to print 1099 forms at home Here s how to do it right and avoid costly mistakes with the IRS See tips tips for PDFs Excel sheets QuickBooks Sage 50 and Patriot

.1099 Misc Printable Form Free

1099 Misc Printable Form Free

Free IRS Form 1099 MISC PDF eForms

Download a free PDF of IRS Form 1099 MISC a tax form used to report certain payments made by a business or organization Learn how to fill out the form what payments are reportable and when to file it with the IRS .

Free IRS 1099 Form PDF eForms

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types .

Form 1099 MISC Free Template Dropbox Sign

An IRS Form 1099 MISC is used to report payments other than employee compensation made by a business across a tax year Use this free 1099 MISC template to take the hassle out of the filing process Simply hit download fill in your details and send it in to the IRS .

What Is the IRS Form 1099 MISC TurboTax

Form 1099 MISC reports payments other than nonemployee compensation made by a trade or business to others This article answers the question What is the 1099 MISC form after the reintroduction of the 1099 NEC .

2024 IRS Form 1099 MISC Legal Templates

Use 2024 IRS Form 1099 MISC to report miscellaneous income in the form of rent royalties prizes and other applicable non wage payments .

Form 1099 MISC What is it for H R Block

Form 1099 MISC can be confusing because it can report various types of income Learn how to read the 1099 MISC boxes with the experts at H R Block .

Disclaimer: All pictures featured on this site are the property of their corresponding copyright owners. If you have any kind of questions or issues relating to image acknowledgment or contact us.